Today’s housing market is different than it was in 2008.

It used to be easier to qualify for home loan. Now, lending standards have tightened, so today’s buyers are more qualified.

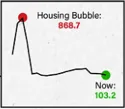

On the left is The Historical Data from the Mortgage Credit Availability Index (MCAI)

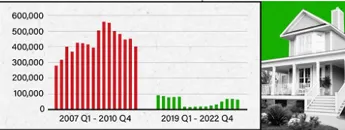

Below are the Foreclosure Starts: Past and Present

– As a result the number of foreclosures has significantly declined over time.

– At the same time there is an undersupply of homes available for sale today, which keeps prices from crashing.

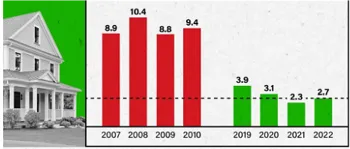

Data Below shows the Annual Average of Month’s Supply of Homes for Sale

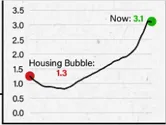

Home price gains has resulted in near record amounts of equity and that puts home owners in a much stronger position.

Data on the left Shows Total US Homeowner Equity (in Trillions of dollars)2007-2022

If you are concerned about a crash, let’s connect and discuss why this isn’t like last time